Managing money can be overwhelming, but thankfully, there’s plenty of free personal finance software out there to help. Whether you’re just starting out, or you’re looking to take control of your finances more effectively, these tools can help. Below is a list of top 3 free personal finance software that can help you unlock your financial potential:

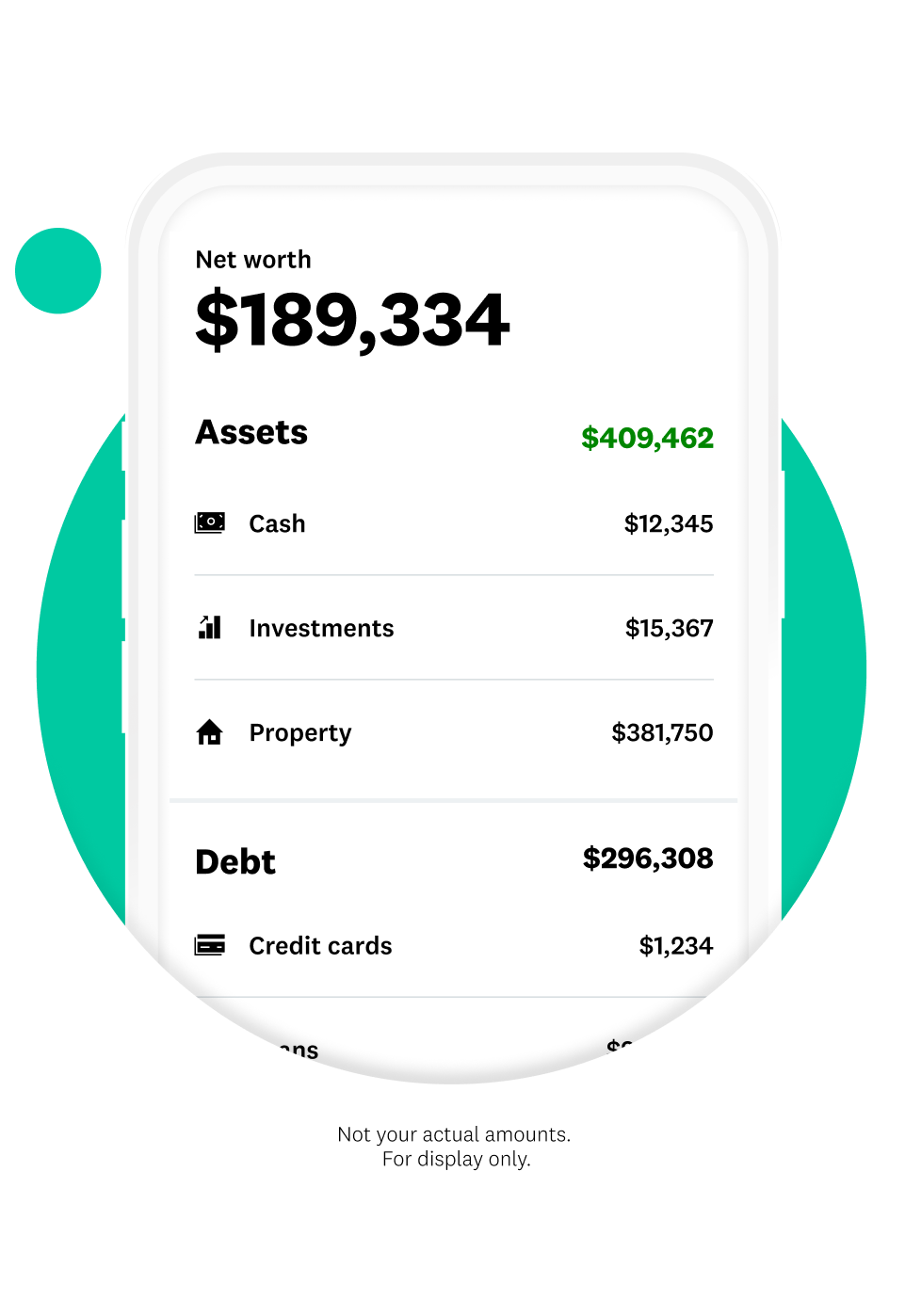

1. Personal Capital https://www.personalcapital.com

https://www.personalcapital.com

Personal Capital is geared towards more people who are more into investing. In addition to the usual budgeting tools, it has features for tracking investments and figuring out how much fees your paying for different things. The retirement planner is especially helpful for those looking ahead. It’s one of the best tools for keeping track of assetss

- Free tools: Personal finance dashboard for tracking income, expenses, investments, and net worth.

- Wealth Management Services: Paid services offering financial advice, tax optimization, and retirement planning for high-net-worth clients.

Best features:

Investment Tracking: Connects to various financial accounts, allowing users to monitor investments, asset allocation, fees, and performance.

Net Worth Tracking: Aggregates bank accounts, loans, credit cards, and investments for a complete picture of a user’s financial standing.

Retirement Planner: Tools for planning retirement goals and understanding how different savings and investment strategies impact the future.

Cash Flow Analyzer: Monitors income and expenses over time to provide insights into spending and saving habits.

Fee Analyzer: Identifies fees associated with investment accounts to help users minimize unnecessary costs.

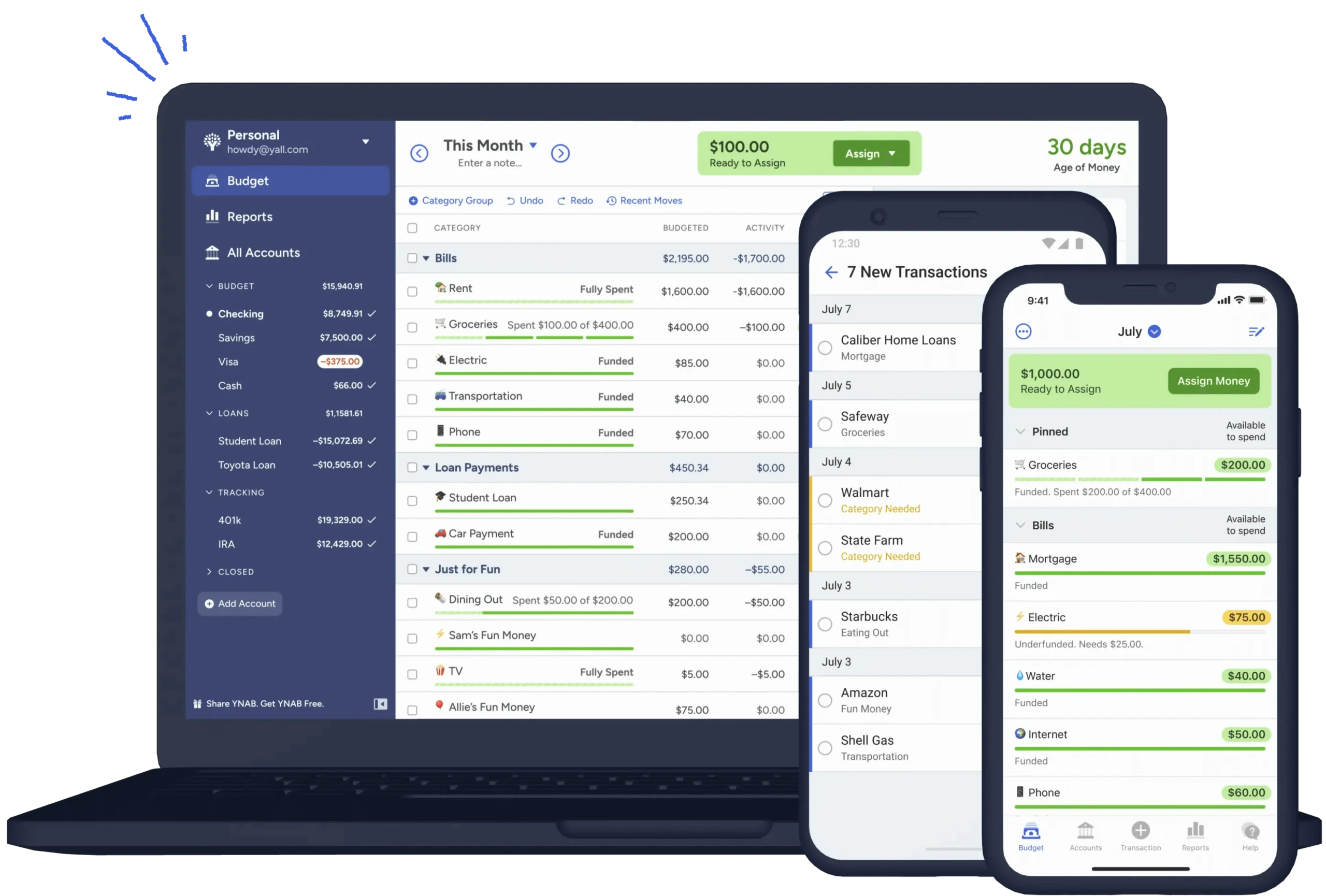

2.You Need a Budget (YNAB)

YNAB (You Need a Budget) and Personal Capital are both powerful financial tools, but they cater to different needs and financial management styles. Here’s a breakdown to help you choose the one that’s best for you:

YNAB | Personal Capital | |

Purpose & Focus | Primarily a budgeting tool that focuses on helping you manage your day-to-day finances, plan your spending, and achieve financial goals through disciplined budgeting. It is rooted in the philosophy of zero-based budgeting, encouraging users to assign every dollar a specific purpose | A wealth management tool that offers a broader range of features, focusing on tracking investments, net worth, and retirement planning. It’s ideal for individuals who want a holistic view of their financial picture, including investments, and need personalized financial advice. |

Core Features Comparison | Zero-Based Budgeting: Every dollar is allocated to a category (e.g., bills, savings, groceries). | Investment Tracking: Detailed analysis of your investments, including performance, asset allocation, and fees. Financial Advice (Wealth Management): Offers paid services for high-net-worth individuals, including tax optimization, financial planning, and investment management. |

Best For | People who need help budgeting, especially those trying to get out of debt, stop living paycheck to paycheck, or build emergency funds. Users who prefer hands-on control of their finances and want to build budgeting habits. | Those with significant investments who want a holistic view of their financial portfolio and better long-term planning. |

Pricing | Subscription-based at about $99/year. Offers a 34-day free trial. | Personal Capital: The basic financial tools (investment tracking, net worth analysis, etc.) are free. However, personalized wealth management services (for those with significant assets) start with a fee of about 0.89% of assets under management annually. |

Which One Should You Choose? | YNAB if you want to get hands-on with your budgeting and need help managing daily spending. Your focus is on short-term financial management, staying out of debt, and building better habits. | You are more focused on investing and long-term financial planning. |

Simple as that YNAB is ideal for people who need structure and discipline around their budgeting, while Personal Capital is suited for those looking for investment tracking and a broader view of their financial life See what you need and choose accordingly.

3.Mint

Comprehensive personal finance tool with budgeting, bill tracking, investment tracking, and credit score monitoring. A great free alternative that offers some of the best features of both YNAB and Personal Capital is Mint by Intuit..

Why It Might Be Better:

- Free: Unlike YNAB and Personal Capital’s paid tiers, Mint offers all its features at no cost.

- Automation: Syncs automatically with bank accounts, credit cards, loans, and investments, reducing manual input.

- All-in-One: Combines budgeting, investment tracking, credit monitoring, and bill management in one place.

- Investment Tracking: Offers basic investment tracking, showing your portfolio performance and asset allocation.

- Bill Reminders & Alerts: Keeps you on track with bills by sending notifications and due date alerts.

- Credit Score Monitoring: Provides free credit score monitoring and insights into factors affecting your score.

- Goal Setting: Helps you set and track financial goals like saving for a vacation or paying off debt